What will your timber be worth tomorrow?

Logs are a commodity traded in competitive markets, know real prices before you start negotiations.

Derived Demand: Timber as the Thermometer of the Economy

In macroeconomic terms, the demand for timber is a derived demand—it originates not from consumers purchasing logs, but from the demand for the finished products they become. When people build homes, remodel structures, or expand infrastructure, they purchase lumber, not logs. Lumber manufacturers, in turn, purchase logs to meet that demand. As a result, timber prices rise and fall in rhythm with broader economic cycles.

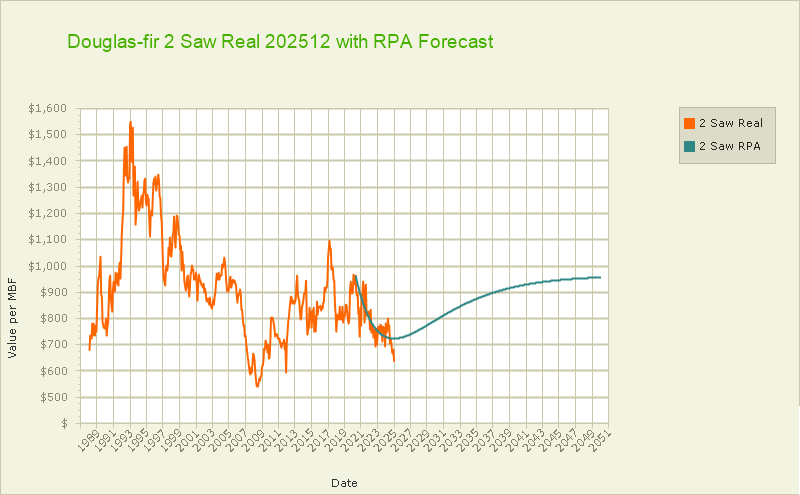

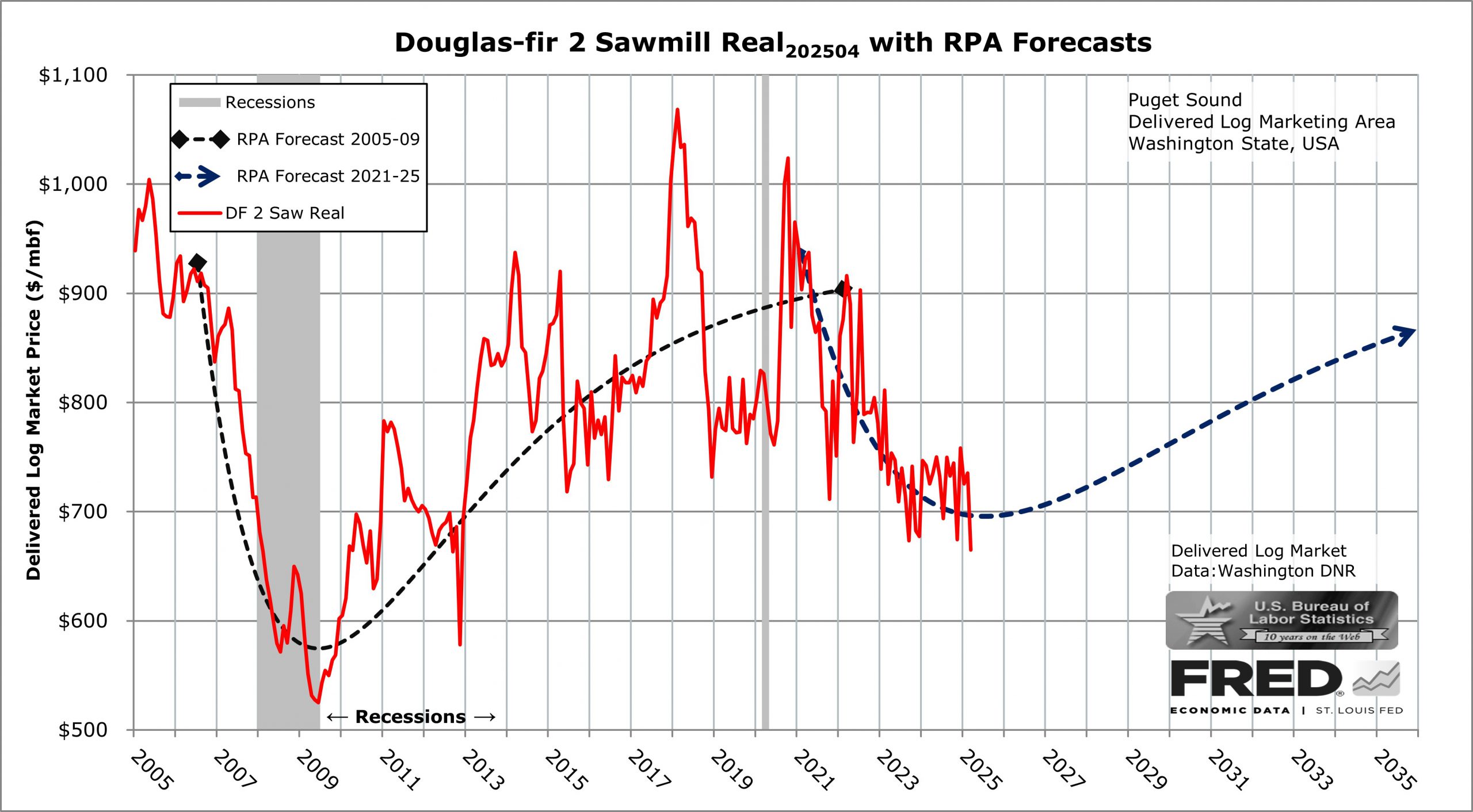

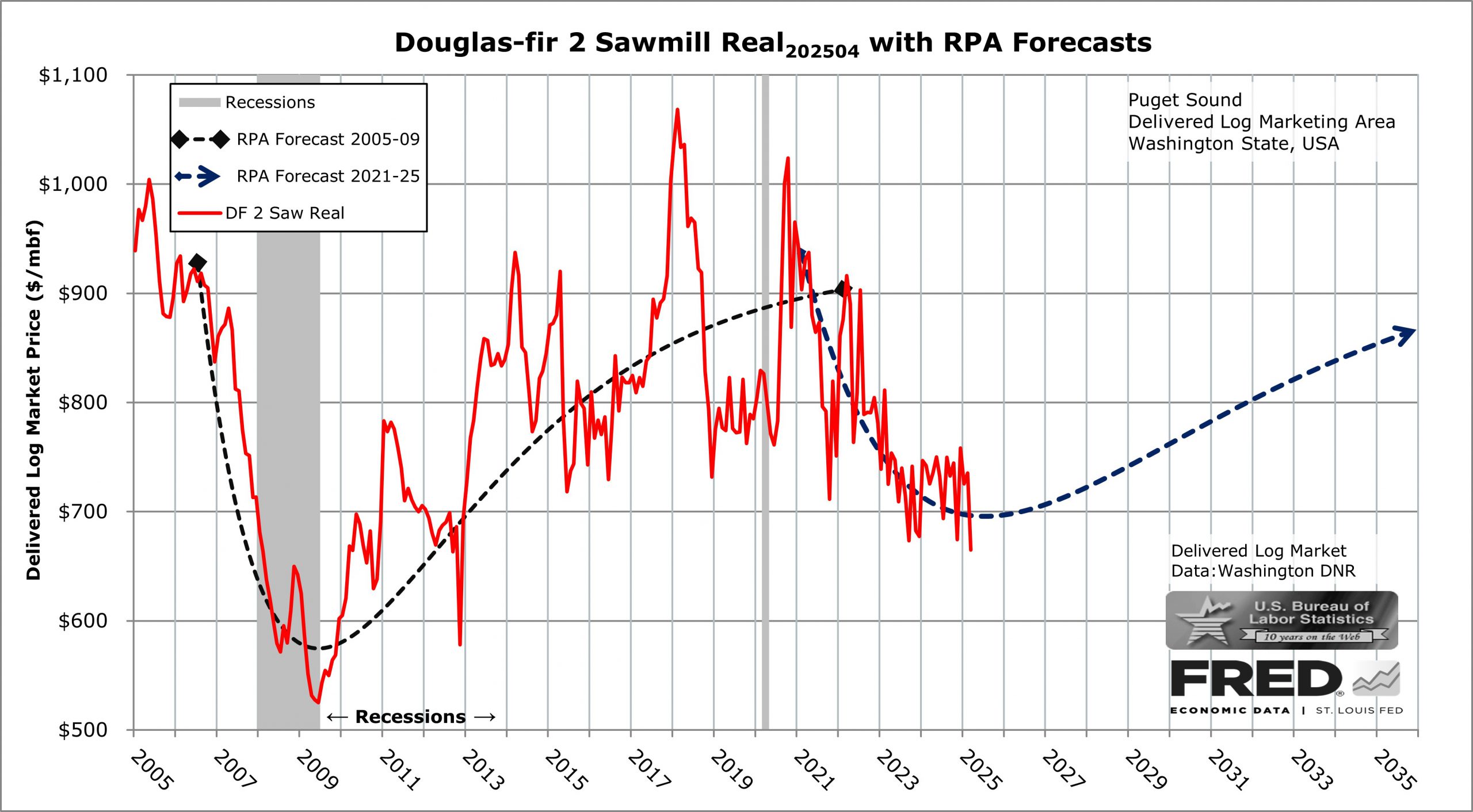

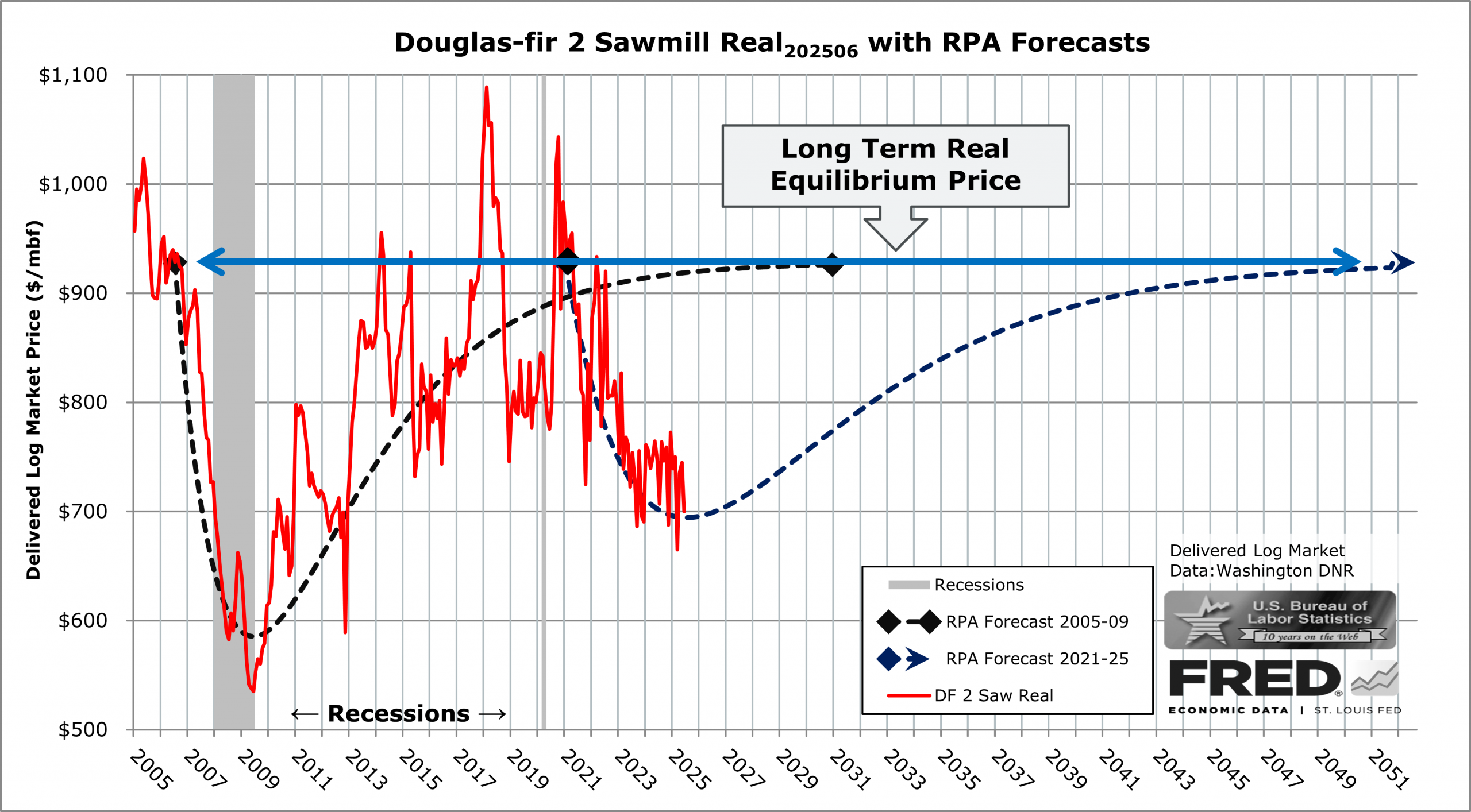

The Real Price Appreciation (RPA) Forecast Tool in FRASS translates these economic rhythms into measurable signals. When housing starts accelerate, demand for lumber strengthens, pulling log prices upward. When mortgage rates rise and construction slows, lumber production contracts—and the derived demand for logs declines. This relationship makes delivered log prices a kind of economic thermometer, showing where growth is heating up or cooling down long before the macroeconomic statistics are published.

By isolating these cycles from random market noise, the RPA Forecast Tool reveals the long-term equilibrium path of timber value. It transforms logs from static commodities into dynamic indicators of national economic health, connecting forest valuation directly to the pulse of the real economy.

Timber is bought and sold in competitively priced, open markets, where equilibrium prices are settled between buyers and sellers. Sellers who are not frequently engaged in these transactions face a challenge to anticipate equilibrium prices. The Real Price Appreciation Forecast Tool is aligned within individual timber markets to create a Reserve Price Indicator for individual timber sorts and grades. When combined with forest Growth & Yield predictions, results guide forestland owners to achieve financially optimal financial returns.

Journal of Forest Policy and Economics

Real price appreciation forecast tool: Two delivered log market price cycles in the Puget Sound markets of western Washington, USA, from 1992 through 2019

Published April 2020