Biometric Coverage Across North America

The Forest Vegetation Simulator (FVS) provides the biometric backbone of the FRASS platform. FVS is the U.S. Forest Service’s nationally supported growth and yield system, calibrated through regionally specific variants that reflect forest type, climate, and disturbance regimes. FRASS builds directly on this framework to ensure that all downstream valuation is grounded in defensible, federally supported forest growth science.

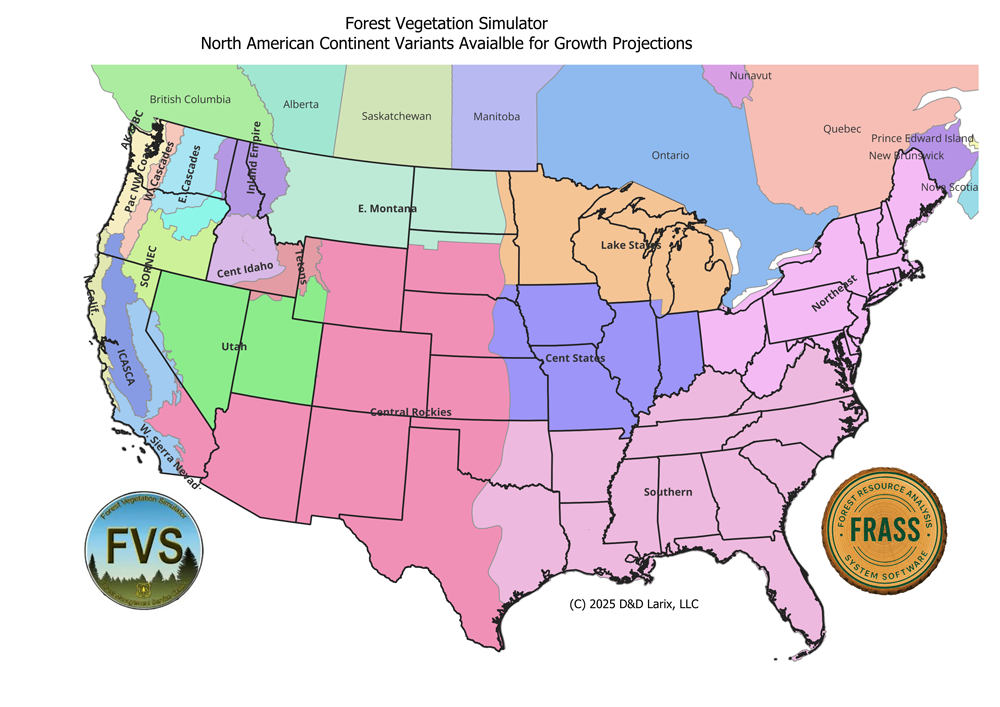

Each color in Figure 1 represents a distinct FVS variant, calibrated to regional forest conditions such as species composition, productivity, disturbance regimes, and management history. FRASS inherits this regional specificity directly, ensuring that tree growth, stem form, and volume reconciliation are consistent with accepted biometric standards throughout the continental United States.

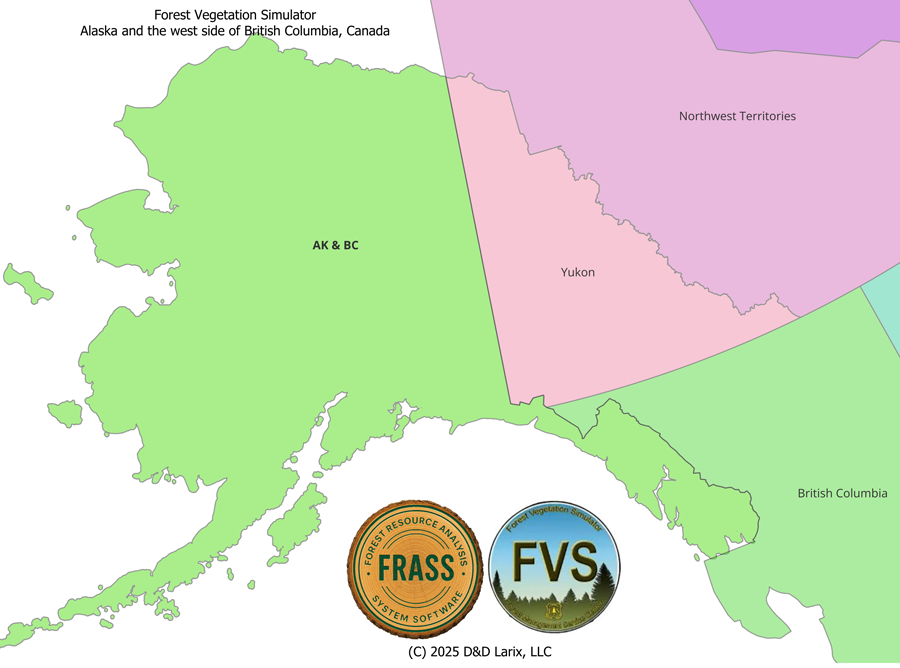

Alaska and the coastal forests of British Columbia are presented separately because their growth dynamics differ substantially from those of the continental United States. Longer rotations, distinct disturbance regimes, and coastal climate influences require specialized biometric treatment. FRASS maintains this separation explicitly to preserve biological accuracy while enabling seamless integration with delivered log markets operating in both U.S. Dollars (USD) and Canadian Dollars (CAD).

From Growth Science to Financial Valuation

Where FVS defines biological growth and volume reconciliation, FRASS adds the financial dimension. Delivered Log Market Portfolios anchor each analysis in the regional market where logs are actually bought and sold, using observed monthly prices from markets characterized by many buyers and many sellers.

For each market region, FRASS maintains a continuous monthly time series of delivered log prices by species and grade. These values are expressed in local currency (USD or CAD) and extended forward using the Real Price Appreciation (RPA) Forecast Tool, which accounts for inflation and landowner impatience factors.

In practice, this integration allows FRASS to optimize tree-level merchandizing by combining FVS-derived stem geometry with forward-looking market behavior. The result is a transparent, reproducible valuation system that links local forest growth with regional and continental-scale economic reality — from the southeastern United States to Alaska and into coastal British Columbia.