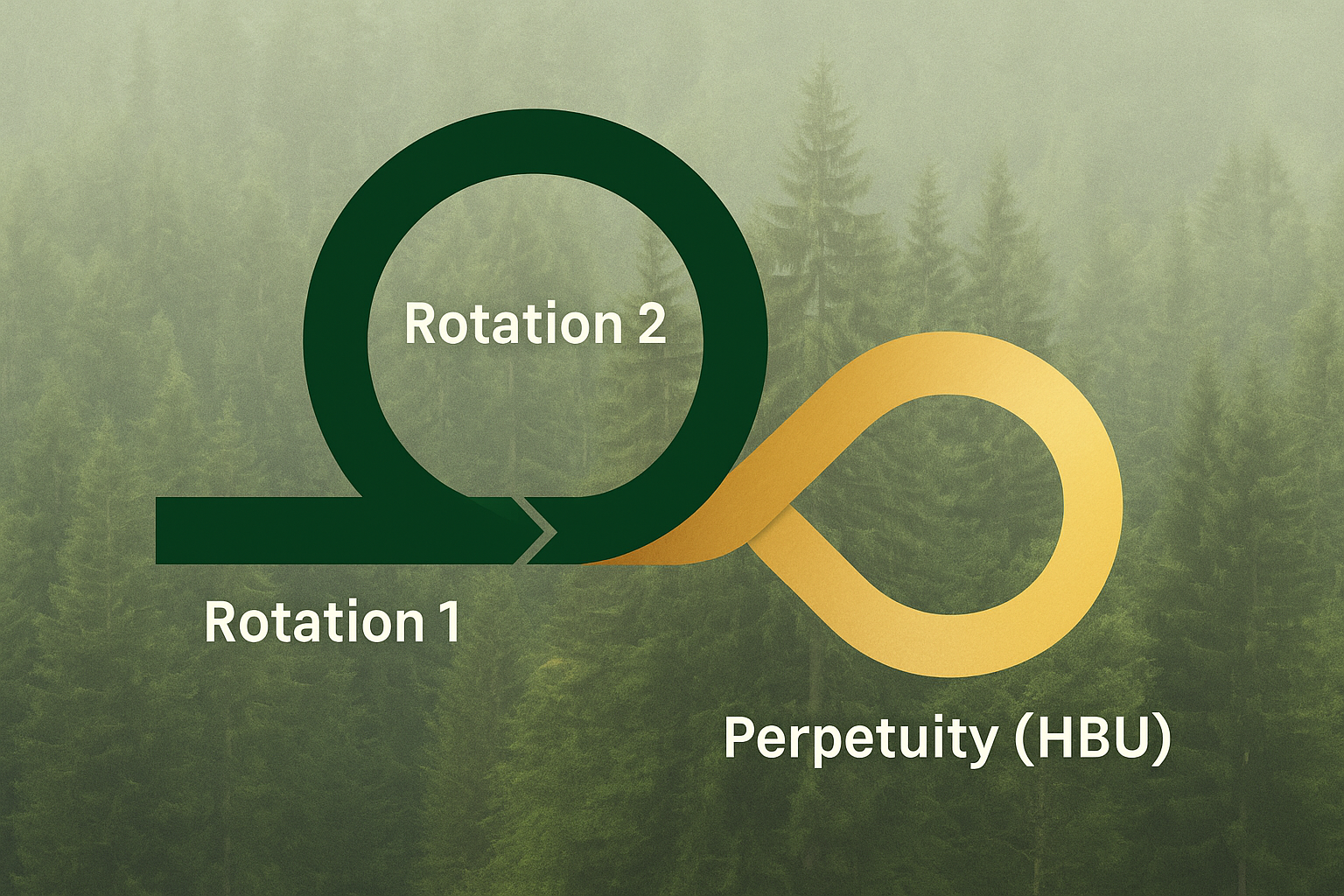

In FRASS, a forest property is not valued by looking at a single harvest. It is valued by following the forest through Rotation 1 (the current stand), Rotation 2 (the replanted stand), and then into a perpetuity tail where rotations repeat in equilibrium. Together, these horizons reveal the Highest and Best Use (HBU) value of the asset and connect directly to the landowner’s financial accounts.

From Stand Growth to Capital Accounts

Every forestland owner ultimately cares about the same question: What is this property worth on my balance sheet, today? FRASS answers that question by modeling the forest as a sequence of cash flows that tie directly to capital accounts, income statements, and long-run return expectations.

For each timber stand, FRASS calculates net cash flows for:

- Harvest revenues by sort & grade (Delivered Log Market + RPA Forecast Tool),

- Logging, trucking, road use, and reforestation costs,

- Management and overhead charges, profit and risk allowances,

- Timing effects driven by discount rate and impatience factor.

These flows are discounted back to today to express a stand-level Net Present Value (NPV), which directly supports the owner’s stated discount rate and appears as defensible value in financial reporting.

Rotation 1: The Existing Stand

Rotation 1 begins with the trees currently on the stump. FRASS combines biometric projections with Delivered Log Market and RPA portfolios to determine the financially optimal harvest year for that stand. The resulting harvest cash flow, reforestation cost, and residual values are discounted into today’s terms.

On the owner’s books, Rotation 1 represents the most immediate contribution to asset value and near-term income, and it anchors expectations for the next cycle.

Rotation 2: Reinvestment and Future Capital

After Rotation 1 harvest, FRASS does not stop. Reforestation is treated as a reinvestment decision—a cash outflow that seeds the next asset. Site preparation, planting, early silviculture, and growth trajectories combine to define the Rotation 2 forest on the same ground.

Using the same market assumptions, discount rate, and impatience factor, FRASS projects Rotation 2 cash flows forward to its own optimal harvest year. That future harvest and its associated costs are again discounted back to today. The result is a second NPV, which is added to Rotation 1 to show how current and future forests share the same capital base.

The Perpetuity Tail: Sustainable Value Stream

Beyond Rotation 2, FRASS assumes the system approaches a steady pattern: similar silviculture, similar market conditions (in real terms), and similar timing logic. At this stage, FRASS treats the forest as a perpetual series of rotations and capitalizes the stabilized real net return into a perpetuity value.

This perpetuity tail is not a guess; it is grounded in the same biometric productivity and RPA-informed price dynamics that drive the explicit rotations. It is the missing piece that allows the forestland owner to state a Highest and Best Use (HBU) value consistent with sustainable management and financial discipline.

What This Means for the Forestland Owner

For accountants, appraisers, and investors, FRASS turns timber stands into a time-linked series of financial assets. Rotation 1 informs near-term income and book value; Rotation 2 clarifies reinvestment performance; the perpetuity tail defines the long-run earning capacity of the property.

On the balance sheet, this becomes a single, defendable number for forestland value—supported by:

- Documented growth and yield assumptions,

- Transparent, market-based prices and cost portfolios,

- Explicit discount and impatience factors,

- Rotation-by-rotation cash flow projections.

For decision makers, this structure answers: “If we manage these stands according to our stated objectives, what perpetual return and capital value do we achieve?”

Explore FRASS Economics

RPA Forecast Tool

Cycle-aware real prices by sort & grade at the markets where logs are sold.

Managing FRASS Economics

Delivered Log Market and RPA portfolios that drive valuation.

Financial Growth & Decay

How inflation and impatience shape timing and value.

Rotations & Perpetual Valuation

Two explicit rotations plus a perpetuity tail to support HBU.