GROWTH AND DECAY

Economic Explanations for Realities in Forestland Stewardship

Defining Value Through Time

In forestry, growth and decay are both biological and financial. The rate at which future revenues lose value in present terms is determined by each owner’s discount rate — a blend of inflation and personal expectation of return. FRASS captures this dynamic through two measures: the macroeconomic inflation trend and the landowner’s impatience factor.

As these forces interact, they define how long capital remains patient in a stand of trees. When patience is high, rotation lengths extend and biological growth dominates financial strategy. When impatience rises, rotation lengths shorten and value is harvested sooner to capture immediate returns.

The Impatience Factor in Action

The Impatience Factor is FRASS’s measure of how a landowner’s time preference translates into financial decay. It represents the psychology of investment made explicit in numbers. When the impatience rate exceeds inflation, present value erodes quickly and harvests occur earlier; when it falls below inflation, value is preserved and forest assets are held longer.

FRASS converts these behaviors into quantitative models so that decisions about rotation timing are driven by financial logic rather than intuition or guesswork.

Discount Rates and Market Reality

Each forestland owner approaches discounting differently. Institutional owners may target 3–5 percent returns; private investors often demand 8 or more. FRASS lets users simulate alternative discount scenarios and observe how rotation lengths and NPV shift accordingly. This creates clarity in transactions where buyer and seller apply different rates yet both perceive profit.

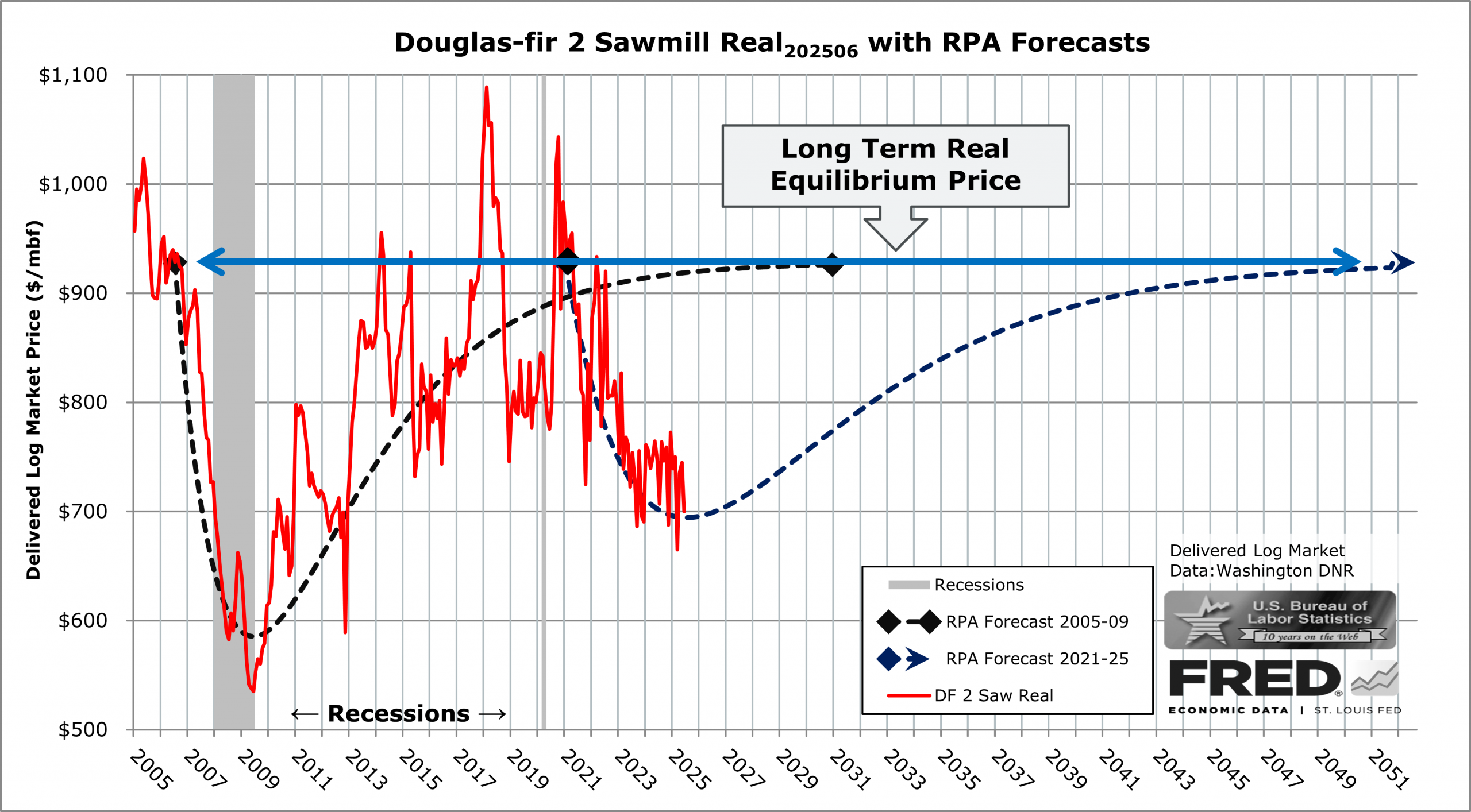

Inflation adjustments draw from U.S. Bureau of Labor Statistics FRED indices, converted to monthly real values. The result is a living framework that shows how forestland value rises and falls with macroeconomic forces.

Low Discount Rate Scenario

Patient capital accepting lower returns allows stands to grow toward biological maturity. FRASS shows these strategies producing higher volumes and premium log grades through time.

High Discount Rate Scenario

Impatient capital demands faster recovery. FRASS models how harvest timing shifts forward and perpetuity values contract under rapid discounting, helping balance risk and reward in multi-rotation planning.

From Theory to Application

FRASS integrates inflation, impatience, and delivered log markets to produce continuous valuation curves. These curves identify the optimal harvest year for each stand and project returns into future rotations. Combined with the RPA Forecast Tool and Rotation Module, Growth & Decay forms the economic heartbeat of FRASS.

See also: Managing FRASS Economics.

Explore FRASS Economics

RPA Forecast Tool

Cycle-aware real prices by sort & grade at the market where logs are sold.

Managing FRASS Economics

Portfolios, collaboration, transparency, and perpetual planning.

Financial Growth & Decay

How inflation and impatience shape timing and value.

Rotations & Perpetual Valuation

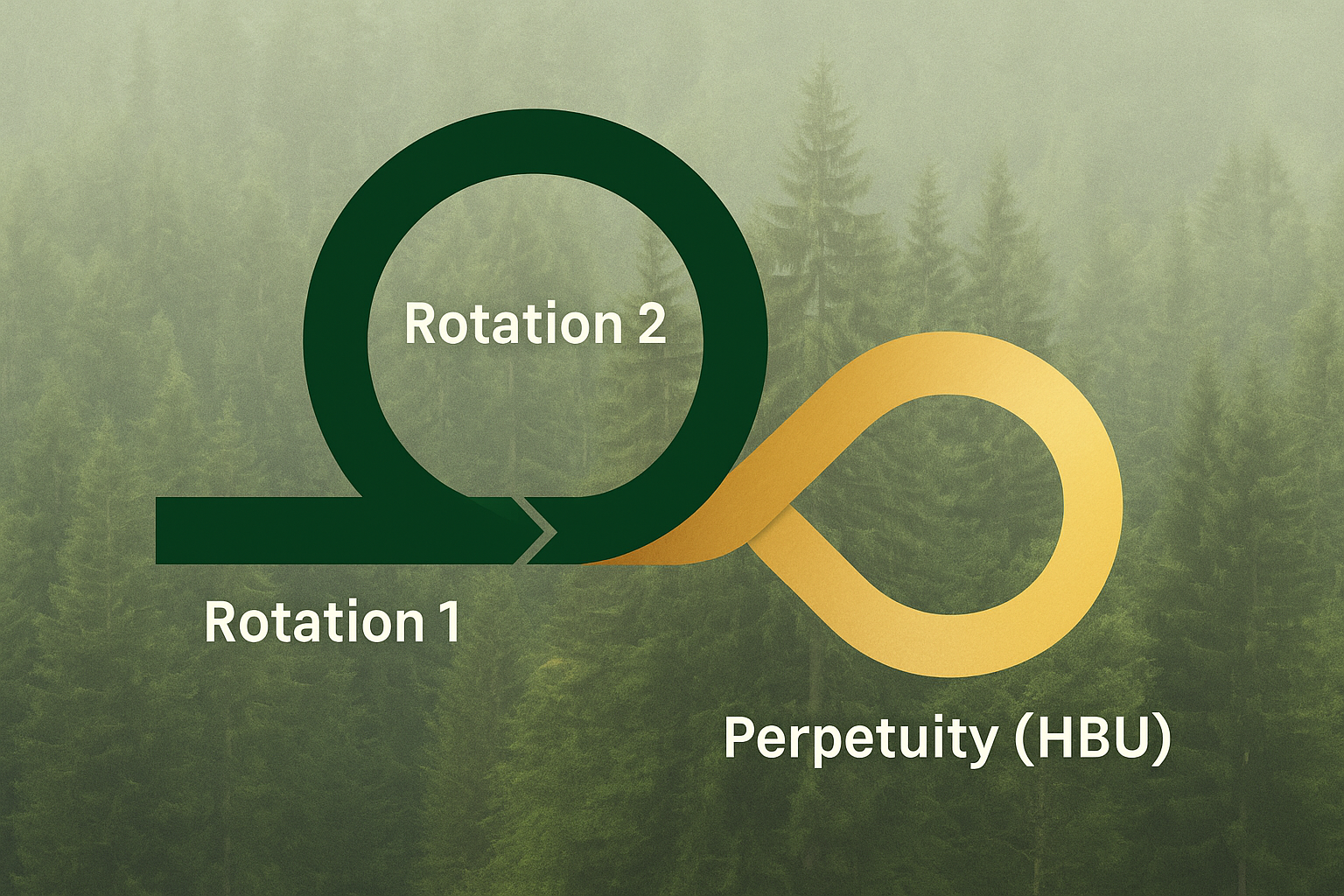

Two rotations plus a perpetuity tail to achieve HBU.

In this short presentation, Dr. William Schlosser explains how FRASS integrates biometric growth, delivered log market data, and inflation-adjusted pricing to reveal real-time value discovery. This demonstration connects the Financial Growth & Decay concepts with the broader FRASS Economics framework and illustrates how value timing emerges through the Impatience Factor and market cycles.

Rotations & Perpetual Valuation

FRASS models timber management through time—one rotation, two rotations, and into perpetuity. This section explains how growth, decay, price cycles, and reforestation costs converge to reveal the Highest and Best Use (HBU) value of every forestland asset.

The Logic of Sequential Rotations

Every timber harvest marks both an ending and a beginning. FRASS evaluates each rotation as a self-contained investment horizon with its own cash flow, then links it to the next through reforestation and regeneration assumptions. These chained rotations create a continuous financial trajectory extending centuries ahead.

The system computes Rotation 1 (existing stand), Rotation 2 (replanted stand), and Rotation 3 → ∞ as the perpetuity tail where growth and decay reach equilibrium. Each rotation inherits costs, prices, and discount rates from the Delivered Log Market and RPA Portfolios, ensuring consistent comparability through time.

Reforestation and the Continuity of Value

Following each harvest, FRASS automatically applies reforestation costs and expected stand establishment schedules. These are not simply expenses—they are value bridges that carry the property forward into the next rotation. The model recognizes that sustainable value requires the next crop to be financially viable from the moment it is planted.

Through this continuity, FRASS avoids the truncation error that plagues single-rotation appraisals and instead expresses full asset value across time.

From Terminal Value to Perpetuity

In classical finance, perpetual value is derived from a terminal capitalization of net income. FRASS refines this by connecting perpetual value directly to biometric productivity and market dynamics. Once growth, decay, and real price cycles stabilize, the system computes the perpetual return—essentially the forest’s long-term equilibrium where each rotation sustains identical real value.

This integration yields the Highest and Best Use (HBU) determination for working forests. It quantifies what most analyses treat qualitatively: the point where infinite rotations converge into a single, stable valuation stream consistent with sustainable harvest policy and investor objectives.

Explore FRASS Economics

RPA Forecast Tool

Cycle-aware real prices by sort & grade at the market where logs are sold.

Managing FRASS Economics

Delivered Log Market & RPA Portfolios; collaboration and transparency.

Financial Growth & Decay

How inflation and impatience shape timing and value.