Your Property, FRASS Economics, Your Choices

The FRASS Platform Provides the Structure, You Control the Trajectory

Portfolios are at the Heart of FRASS Economics

Delivered Log Market (DLM) Portfolios

Defines financial conditions surrounding each harvest event.

Includes current prices and costs by sort & grade, inflation and discount assumptions, and region-specific logistics. These inputs determine cost of delivery and the net return realized by the forestland owner.

- Inflation and Discount Rates

- Road Use and Access Fees

- Maintenance & Hauling Costs (distance-based)

- New Road Construction & Reforestation Expenses

- Delivered Log Prices by Sort & Grade

- Logging Methods & Overhead Allocation

- Profit & Risk Rates by Sort & Grade

Each variable is adjustable. Model helicopter vs. ground systems, fuel-price sensitivity, and trucking distance penalties. FRASS merges these with stand biometrics to calculate value and timing.

Real Price Appreciation (RPA) Portfolios

Projects delivered log price cycles into the future.

Derived from long-term market observations transformed into real prices (nominal values adjusted for inflation using FRED indices). Applied by log sort & grade to estimate how appreciation or devaluation influences revenue timing.

- Cycle signals vs. shocks/noise

- Market-specific curves (by sort & grade)

- Monthly inflation adjustment (FRED)

- Forward price paths & equilibrium levels

- Sensitivity to macro regime shifts

Combined with DLM, RPA produces a cycle-aware horizon that mirrors actual markets and drives timing and reserve-price logic.

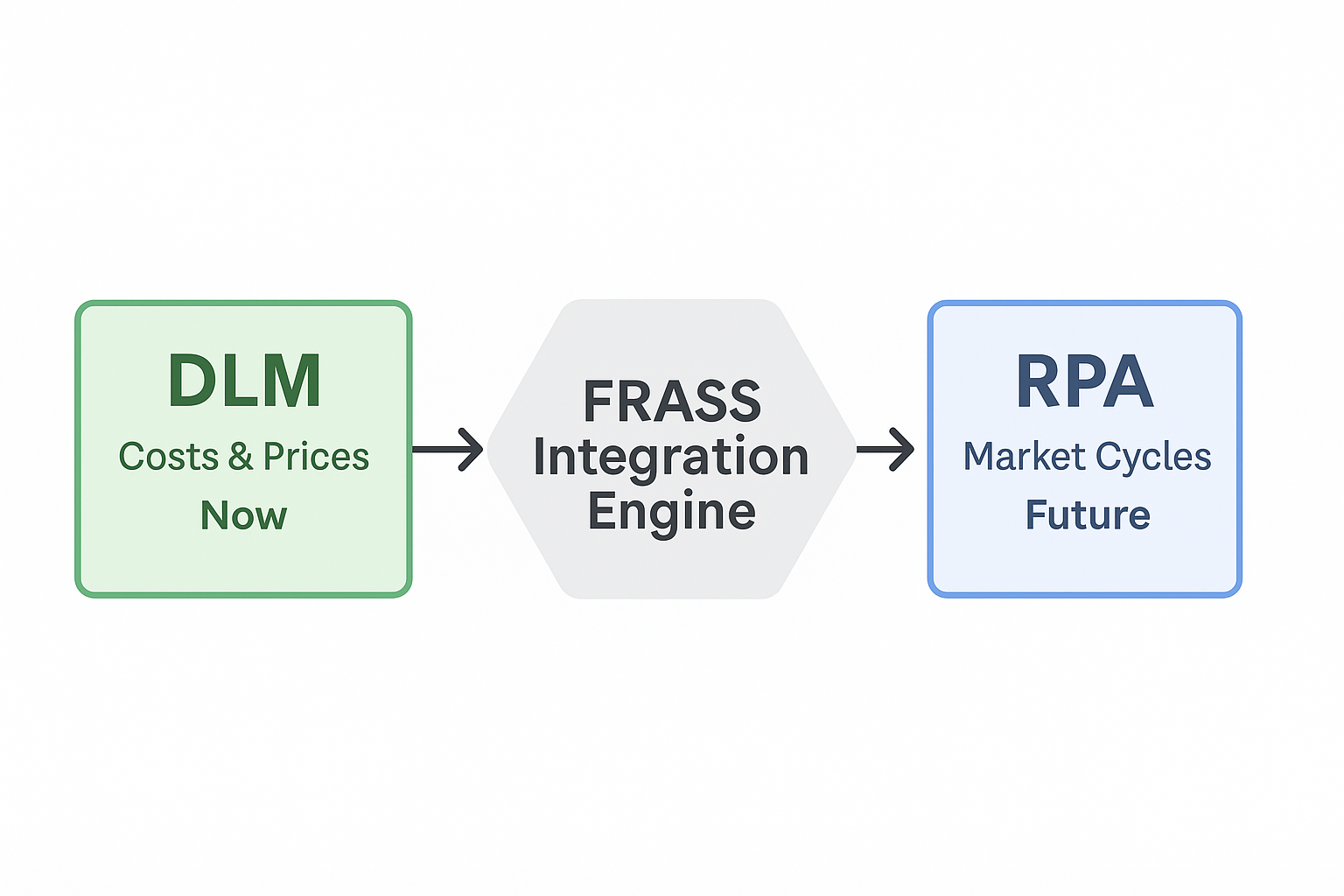

Figure. FRASS Integration Engine — Delivered Log Market (DLM) and Real Price Appreciation (RPA) Portfolios converge to form a unified analytic structure, transforming costs and prices into dynamic valuation and harvest timing intelligence.

Integration Creates Meaningful Power

The Delivered Log Market (DLM) Portfolio establishes the financial foundation of each timber harvest—linking cost structures, access logistics, and local market realities. The Real Price Appreciation (RPA) Portfolio defines the temporal dimension— how real prices evolve through time as inflation and market forces interact. When combined, these two frameworks transform static market data into a living, dynamic model that forecasts both cost and value with precision.

FRASS integrates DLM and RPA at the stand level, matching each tree’s projected growth and sort distribution with the financial pulse of its market. This synthesis allows the system to forecast revenue potential by date and optimal harvest timing by value. Rather than applying a single inflation rate to all commodities, FRASS uses the RPA curve to reflect the true rhythm of market appreciation and devaluation—providing a cycle-synchronized financial lens that traditional models lack.

The result is a continuously updated economic feedback loop. Delivered Log Market data anchors the present; Real Price Appreciation extends into the future. Together, they empower forestland managers, appraisers, and investors to act on quantified intelligence—balancing biological growth, operational cost, and economic timing to achieve sustainable, defensible, and profitable decisions. This integration is what makes FRASS not just a model, but a complete Forest Resource Analysis System Software.